One of the most important single ideas that caused Western Civilization to evolve into the rich and prosperous place it has been for about 400 years now is what was once known as the Protestant Work Ethic.

While there are Calvinistic theological underpinnings behind it, the Protestant Work Ethic plays out primarily in the world of economics. It explains how the Protestant areas of Europe, and the United States, grew so prosperous, so consistently.

It’s amazingly simple. The Protestant Work Ethic has three main precepts, applied both to the individual and to society:

- Productive work

- Frugality

- Savings

It is not difficult to see how any society that practices those things will over time grow rich. The society that produces more than it consumes will own more at the end of the day, every day. The one that consumes more than it produces grows ever poorer. European and American prosperity is the result of neither “White privilege” nor colonial exploitation, but math. It’s the predictable and experiential result of capital accumulation and production and longer time preferences.

But somewhere in the last century, we gave up on the idea of saving and frugality, and even productive work. It was right at the time where we started measuring activity. We call that measurement GDP, gross domestic product, and it is essentially the sum of our collectively-produced goods and services.*

But somewhere in the last century, we gave up on the idea of saving and frugality, and even productive work. It was right at the time where we started measuring activity. We call that measurement GDP, gross domestic product, and it is essentially the sum of our collectively-produced goods and services.*

Unfortunately, GDP under the Keynesians has also become the ideological end-all-and-be-all of our economy. More GDP is always considered a good, and any strategy to increase spending is counted a noble endeavor. It’s good to pay one man to dig a hole and another to fill it. It’s a plus to build bridges to nowhere. You can do $50 billion in damage to homes and businesses, and the Keynesians will cheer that the economy is thereby helped. It’s madness.

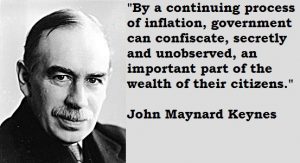

Since Keynes and especially neo-Keynesians fell in love with the idea of measuring activity no matter its ultimate worth, we have finally come to the point where no eyebrows are raised when a Keynesian says that the solution to the economy’s current funk** involves stealing the wealth of the citizenry if they will not part with it voluntarily:

Encourage spending, not saving. There, in four words, is the pulling of one of the lynchpins of Western civilization. It is the epitome of short-term thinking***.

It is also the path to poverty. Our entire economy, which over the past century has been transmogrified into an orgy of profligacy and living-in-the-now, has been a lot of fun. But we are now unmaking what made us into us. And by the sounds of the cheering, we are loving every minute of it.

* There are a couple of ways of measuring GDP, but it’s basically C+I+G+(Ex-Im), or Consumption + Investment + Government + (Exports – Imports).

** besides destroying the currency, natch.

*** There is no one with a shorter time preference than a Keynesian economist.

I am grateful for every rare occasion when someone points out how US economic policy (esp since Bill Clinton and Phil Graham took office) has destroyed the frugal. I was young, and working in subsidized housing for the elderly in Texas during the 1980s, and saw how the return on a simple passbook savings account could make a real difference in standard of living during retirement. I wonder how many young people know you once could earn 4% or 5% on $500 in a savings account, and 3% on checking – with no service charges.

So, never having a pension, we saved, and avoided debt. We were never upper class, but I always had savings, and never put it into un-insured Money Market or Certificates of Deposit… BECAUSE those were not covered by FICA insurance. Yet when the crash came, Congress and President Bush bailed out the risk takers and protected those funds. Those of us who followed the rules were left out in the cold. They also destroyed the very idea of paying interest to depositors. For the past 10 years we hoped interest would return… but now we know that model is dead.

It was the same with mortgage bailouts. Those of us who paid off our mortgages, or who bought homes we could afford even during hard times, did not get any bonus for looking after our own futures, but instead have to cover for people who were foolish and “built their houses on sand” so to speak.

When the crash hit in 2008, my IRA lost half its value. It never recovered the lost principle, much less made up for the loss of appreciation. Our cash savings never earned interest after that either. So when illness struck, and we needed to make use of our “retirement”, we have been forced to use the principle – because there is no growth at all.

If not for the changes made during the Bill Clinton/Phil Graham Era, we would have been able to have a decent income from simple interest to cover our needs. All we did was just tried to follow the best wisdom of Old America, unaware of what the globalists’ machinations were going to do.

Of course, our Father God provides the asset and the increase, and we have faith that He will continue to provide as He has “heretofore”. But that doesn’t mean forgetting how the elite experiments have brutalized frugal Americans’ financial stability – in much the same way that they brutalized citizens’ jobs.

That is brutal. I am really sorry you got hit so hard, for following the rules.

Seconded. The most infuriating part of this Great Fed Experiment is that they either do not know or do not care whom they are most hurting – those who acted wisely their entire lives.

It is one of the most underreported and vicious of unintended consequences.

The underreported part is what has been most curious to me. Even conservative media rarely, if ever, pick up on it.

Most “Conservative” media is part of the same establishment as the libtards.

Sir, The Fed and the bankers both know and care. They are all to happy to lend and lend. It’s the collateral that is rarely discussed if understood. The banks own our labor, land, and mineral wealth. I disagree with Theophrastus (below) that’s it’s unintended. They are banks. Banks lend and you pay them back. The only difference in this game is they know the bill can’t be repaid and they are counting on it. They own gen Y, our land, property, wealth, and all of our resources. You have been made a debt slave. They know it, and want it. Great article. Protestant Work Ethic? Haven’t heard that term in years. Nice.

Note: I’m gen X. I owe no man, haven’t for years.

I meant unintended from the perspective of the individual. I agree with you.

Welcome to generation X. we never had a majority, never had any power, and paid the price for following the rules we were taught… and now we are despised for the baby Boomer’s machinations we never agreed to.

Let’s hope the up and coming millenials are able to smash the boomer’s corruption permanently.

Millennials tend to share the Boomer’s narcissism. There is still time for GenX to step up. I also have some hope for the “Homeland” generation coming after Millennials. They seem to be better.

I think that the Rise of the alt-right IS GenX ‘stepping up’. It is Ironic though that we have vastly more in common with the 16 year old crowd than we do with the 20somethings.

Brigadon, I think you are correct there, about GenX morphing into the alt-right at maturity. GenX are also our heroes who have been fighting these awful endless wars, and our young veterans know a thing or two. GenX are good people, and are pushing back and standing up.

4.5

5

I don’t mean to say it is not still worthwhile to avoid debt and save cash, and to practice self-reliance. Debt – and government dependence – are both slavery, plain and simple, so it is still wise to live frugally, pay off debts as early as possible, and build a nest egg. When my husband got sick, I was able to care for him at home rather than put him in a nursing home – because we didn’t have debt. It will probably mean I need to go back to work at a time when many of my peers are retiring, but work is not a bad thing. Late life new careers can be a blessing also.

A LOT of young families have made the decision to live better with less on one “job” income so that mom can stay home. That is a good sign that they are prepared to balance their lives, and there’s a wonderful home-business culture surrounding them. Having people around who can do trades such as carpentry, plumbing, welding, and machine repair are essential to neighborhoods so that we can maintain our homes and help each other. The frugal life and strong work ethic is not endangered in all places, but does need to be given more attention and supported. This is one of the things I love about President Trump is his vigorous teaching, and active practical methods for promulgating these values.

Yah, me and my friends possess a broad variety of skills, and we ‘trade’ favors like plumbing jobs and such around. Yes, we make less money from doing jobs when part of our time is spent helping friends, but with zero taxable overhead we wind up saving money in the long run by not having to call the professionals.

It helps that we are mostly in the construction trades, or were.

5

That which cannot continue, won’t. But it’s going to be spectacular implosive with heartbreaking results.