After 8 years of not noticing things, the press rediscovers that Social Security is going broke:

Medicare and Social Security are running out of money more quickly than expected, officials said Tuesday.

Government trustees reported that a combination of rising costs and an aging population cut the life expectancy of Medicare’s trust fund to just 8 years…

Meanwhile, higher benefit payouts mean Social Security will have to dip into its nearly $3 trillion trust fund for the first time since 1982 — and trustees warned the program would be insolvent by 2034.

1982, for those not old enough to remember, was the last time Social Security was “saved”, meaning that the Ponzi scheme* was restructured, taxes and retirement ages raised, and the system put on a “pay as you go” basis. The “trust fund” quickly built up and all the Boomers looking forward to retirement breathed a sigh of relief. Now that they are retiring en-masse, it appears that the green eyeshade brigade downstairs at the Social Security Administration is making some new adjustments that those Boomers might not appreciate.

This may come as a shock to many, but neither Medicare nor Social Security actually have a “trust fund” to dip into. What they have are lots of non-marketable treasury notes, i.e. government IOUs, to the tune of a few trillion dollars. When the SSA “dips into” its fund, it presents a few notes to the US Treasury, which then sells an equal amount of debt on the market and hands the proceeds back to SSA for distribution. The “Trust Fund” merely represents the cumulative amount of money collected in Social Security taxes that Congress has spent on funner things, like sexual harassment settlements. It’s an accounting ledger, and the numbers are not looking good.

So what happens next? In the short term. Probably nothing. Eight years is four election cycles, and no one wants to touch this before it becomes critical. And even when the trust funds run out, there will probably be “emergency” appropriations in plenty, with Congressmen bragging with each that they are keeping grandma from eating dog food, so vote for them**.

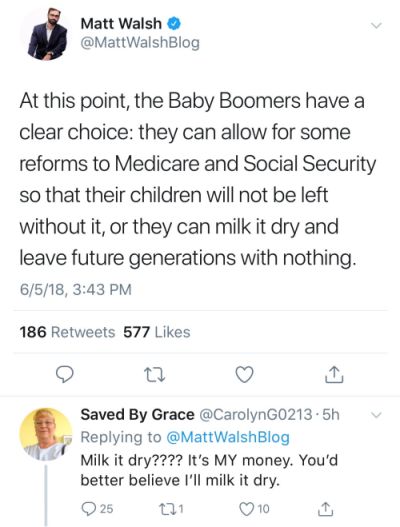

In the long term, however, Social Security as we know it is going to die. It cannot be sustained no matter how many gardeners we import. But it cannot be eliminated, either: too many votes depend in it. The largest generation in history is going to milk it dry and will defend their right to do so via the ballot box.

What happens when a program cannot be funded and cannot be eliminated? This is government we’re talking about: it gets funded. And if the money cannot be borrowed, it will be printed. And if it’s printed, the checks going out might not be worth much. There’s lots of money in Argentina, after all. And math works the same way in every country.

“But what are we to do about it?” you might ask. If by that you mean, “How do we save Social Security and Medicare?” I don’t believe we can. Oh, we can and will make adjustments, but in the end they are a free lunch. You may say there’s no such thing, but those eating disagree.

But if you mean, “How do we protect our families from the inevitable fiscal holocaust that decades of government overpromising on all levels is certain to bring about?” there I might be able to help.

Step 1: Write it off. Unless you are already retired, the likelihood of the government giving you a valuable check every month for decades is negligible. Whatever you plan on for retirement, plan on not seeing meaningful checks from Uncle Sam. If you do get them, consider it a bonus.

Step 2: Get free of debt. Most of us work as much as we do because we are paying Uncle Sam and the bank, in that order. You can only pay Uncle Sam less by purposely earning less***. But you can pay the bank nothing by paying off your debts and not incurring more. Maybe you can’t do it completely, but we can all do it mostly.

Step 3: Get the hell out of the way. The whole West is headed for trouble, of which hyperinflation and civil unrest are only parts.**** We cannot continue to do what we are doing, and not doing it will have bad consequences for everyone, but mostly for those who are a) wholly dependent upon government, and b) surrounded by lots of a).

America is headed down a road fiscally, socially, and politically that goes bad places. We have a little breathing room, perhaps, because social inertia is powerful. But at some point, the well runs dry. You’ll likely see it. I would hope that it is not to you a surprise.

* One of the fiercest drivers behind open borders immigration both here and in Europe is the knowledge that these modern retirement systems demand an ever-larger number of young workers paying taxes. While importing them won’t work for many reasons, self-delusion hope springs eternal.

** or do you hate Grandma that much?

*** That said, it is not hard to live well in America on half of a Virginia/New York/California salary. You just can’t live in Virginia, New York, or California.

**** There’s plenty of talk about civil war, secession, and the like. How well do you suppose WalMart’s warehouse on wheels will operate once the hijacking starts? How well do you suppose most people will eat the next week?

5

Good advice. Anyone who is in debt is setting themselves up for failure and pain. I have no idea if SS will be around when I retire, but I am planning as if it will not. If it somehow sticks around and I get something, then fine.

3.5

Your comments are reality-based and helpful. They’ve been timely for decades now. I will willingly support either ending the SS benefits I do receive, or changing the system to where those who ARE responsible for taking and using the moneys pay into the system for their own purposes(the gov) are held responsible and have to pay the price for making it hones(ain’t gonna happen). However I do take exception to characterizing those who receive SS benefits as getting a “free lunch.” I figured out when I made the decision to start receiving SS that it would be decades before I used up the money I paid into it with the understanding that it would go to my retirement. By God’s grace, we are in a position to not have to use any of it, and we choose instead to gift it to our children now, instead of later since later it might not be worth anything by then.